Wall Street to Open Flat Ahead of Payroll Data

U.S. stock futures are mostly flat Thursday after the Dow snapped a four-day winning streak, with investors eyeing jobless claims data ahead of Friday’s key payroll report. Dow futures are unchanged, while Nasdaq and S&P 500 futures edge lower following modest gains in the previous session. Bitcoin trades below $105,000, slightly lower. The 10-year Treasury yield is declining, while gold futures rise above $3,400 an ounce. Oil prices are also moving higher, reflecting cautious optimism in broader markets.

Points to Know Before Market Opens

Tesla CEO Elon Musk escalated his criticism of Trump’s budget bill, calling it a “disgusting abomination” and urging supporters to pressure lawmakers to reject it as it heads to the Senate.

Boeing will pay $1.1 billion to avoid prosecution over two fatal 737 MAX crashes, including funds for safety improvements and victim compensation, as DOJ charges the company with fraud.

Procter & Gamble will cut 7,000 non-manufacturing jobs, or 15% of that workforce, amid weaker sales and a lowered outlook. The restructuring will incur up to $1.6 billion in charges.

U.S. April new home sales data is expected at 10 a.m. ET, forecasted at 695,000, down from March’s 724,000, as high interest rates and tight inventory weigh on housing.

Circle Internet Group, issuer of USDC, priced its upsized IPO at $31 per share, above expectations. The $1.05B offering begins trading Thursday on the NYSE under ticker "CRCL."

The 10-year Treasury yield decreased by 0.029 points at 4.336%. The 2-year Treasury decreased by 0.017 points at 3.86%.

Recent Blog

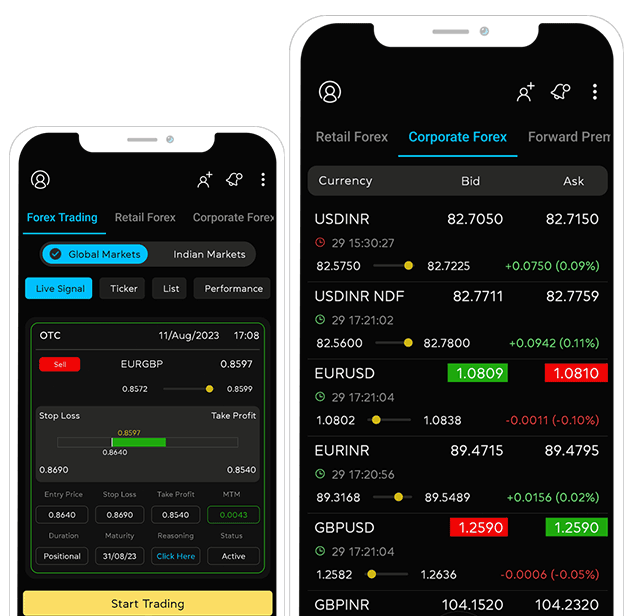

Want to manage Forex?

Newsletter signup

Receive forex updates right in your mail box or Whatsapp