The Indian Rupees Trading Weak At 85.8600 Against The Dollar

Financial Market Overview

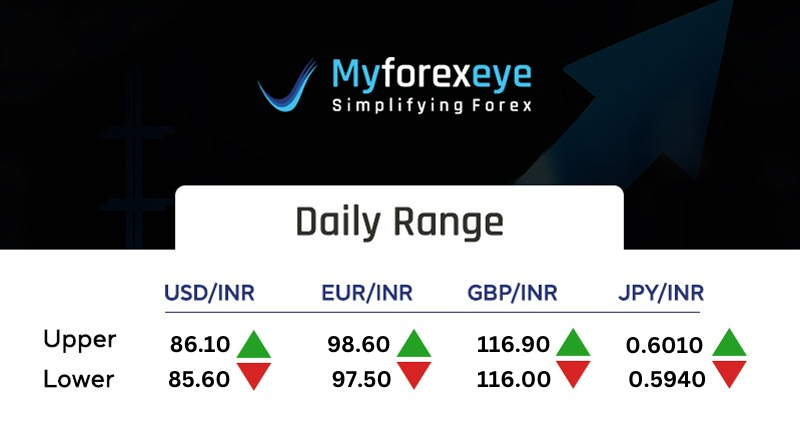

USDINR

The Indian rupee opened weak at 85.88 against the U.S. dollar on Friday, compared to its previous close of 85.79 on Thursday. The Indian rupee opened flat on Friday, as markets brace for the Reserve Bank of India's policy decision and the U.S. non-farm payrolls report later today. While the rupee saw mild gains on Thursday, the broader trend remains downward. The RBI is widely expected to cut rates by 25 basis points, marking its third consecutive reduction amid easing inflation. However, the State Bank of India is forecasting a deeper 50 bps cut. On the global front, the U.S. jobs report will be closely watched, especially as recent tariffs appear to be weighing on the economy. A soft jobs print could bolster expectations of further Fed rate cuts, adding to the pressure on the dollar and shaping rupee sentiment.

United States 10-Year rates were 4.387% on the bond markets, while 2-year Treasury yields were 3.914%. The DXY index trading around 98.78.

At the time of writing, the USDINR was trading at 85.91/85.92.

GBPUSD

The GBPUSD briefly surged above 1.3600 on Thursday, its highest level in over three years, before retreating as investor caution set in ahead of Friday’s key U.S. Nonfarm Payrolls (NFP) report. Market sentiment remains cautious after ADP data showed weaker job growth in May, with NFP projections trimmed to 130K from 177K. Political tensions also weigh on sentiment, as former DOGE head Elon Musk publicly criticized President Trump’s budget bill for omitting earlier spending cuts. The rift between Musk and Trump deepens on social media. Meanwhile, Trump prepares for renewed trade talks with China, following a “productive” call with President Xi. However, U.S.-China relations remain strained amid recent accusations of pre-deal violations in Geneva.

At the time of writing, the GBPUSD was trading at 1.3570/1.3572.

EURUSD

EURUSD continues to decline after hitting a two-month high of 1.1495 on June 5, now trading near 1.1440 during Friday’s Asian session. Market sentiment is cautious ahead of the U.S. Nonfarm Payrolls, expected to show a softer gain of 130,000 jobs in May. U.S. jobless claims rose to 247,000, while ADP data showed just 37,000 new private jobs, missing expectations. Meanwhile, the ECB cut interest rates by 25 basis points to 2.0%, in line with forecasts. ECB President Christine Lagarde signaled the easing cycle is nearing its end. Tensions linger over U.S.-China trade talks, despite a “productive” Trump-Xi call, following Trump’s accusation that China breached a temporary tariff truce agreed upon in Geneva.

At the time of writing, the EURUSD was trading at 1.1441/1.1442

USDJPY

The Japanese Yen (JPY) extended its decline for a second day on Friday following weak Household Spending data and a fourth consecutive drop in real wages, fueling doubts over the Bank of Japan’s policy normalization. Hopes for renewed US-China trade talks and improved risk sentiment also weighed on the safe-haven currency, keeping USD/JPY steady above the mid-143.00s during Asian trading. Despite this, speculation persists that the BoJ may raise rates in 2025 amid rising domestic inflation, potentially limiting further JPY losses. Meanwhile, the US Dollar remains weak near April lows due to deficit concerns and expectations of Fed rate cuts. Traders are now awaiting the key US Nonfarm Payrolls report for fresh market direction.

At the time of writing, the USDJPY was trading at 143.76/143.77.

Recent Blog

Want to manage Forex?

Newsletter signup

Receive forex updates right in your mail box or Whatsapp