The Indian Rupees Trading At 87.5250 Against The Dollar

Financial Market Overview

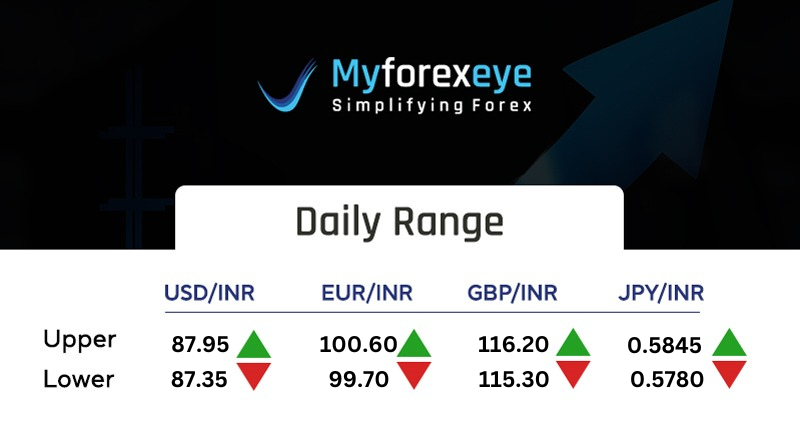

USDINR

The Indian rupee opened weak at 87.61 against the U.S. dollar on Friday, compared to its previous close of 87.59 on Thursday. The Indian rupee opened slightly weaker on Friday, pressured by concerns over steep U.S. tariffs on Indian exports and ongoing foreign portfolio outflows. The rupee fell around 2% in July, nearing its record low of 87.95, as President Trump’s threat of a 25% levy dampened sentiment. Economists warn the tariffs could trim India’s 2025–26 growth by up to 40 basis points. While negotiations may soften the blow, uncertainty persists—especially if pharmaceutical exports are targeted. Foreign investors pulled over $600 million from Indian equities on Thursday, and confidence remains shaky. Broader Asian currencies also weakened, while the dollar stayed firm around 100 as reduced hopes of a September Fed rate cut supported Greenback strength.

United States 10-Year rates were 4.383% on the bond markets, while 2-year Treasury yields were 3.995%. The DXY index trading around 100.06.

At the time of writing, the USDINR was trading at 87.5250/87.5350.

EURUSD

The EURUSD pair edged up 0.10% to 1.1417, recovering slightly after strong U.S. economic data supported the Federal Reserve’s cautious stance on rate cuts. The Fed’s preferred inflation gauge, the core PCE Price Index, beat expectations, while jobless claims fell, underscoring economic resilience. On Wednesday, the Fed held rates steady, though two governors supported a 25 bps cut. Chair Powell emphasized a data-dependent, meeting-by-meeting approach, making a September cut uncertain. The U.S. Dollar Index (DXY) rose 0.16% to 100.05. In the Eurozone, inflation remains near the ECB’s 2% target, with CPI data from major economies showing stability. Markets now await key U.S. releases on Friday, including Nonfarm Payrolls, ISM Manufacturing PMI, and UoM Sentiment.

At the time of writing, the EURUSD was trading at 1.1412/1.1413.

GBPUSD

The GBPUSD pair fell for a sixth straight session, down nearly 3% from last week’s high near 1.3588, as the U.S. Dollar gained strength amid robust economic data. The Fed’s preferred inflation gauge, the core PCE, rose more than expected, while jobless claims declined, signaling a resilient U.S. economy. This reduces the chances of a September rate cut, pushing the dollar higher. Meanwhile, the Bank of England appears more dovish, with UK economic indicators softening. Global trade tensions, reignited by lingering U.S. tariff policies, add to market anxiety. With the U.S. Nonfarm Payrolls report due Friday, sentiment remains cautious. The policy divergence between the Fed and BoE continues to weigh on the Pound’s performance against the Greenback.

At the time of writing, the GBPUSD was trading at 1.3198/1.3199.

USDJPY

The Japanese Yen (JPY) hit a four-month low against the U.S. Dollar (USD) on Friday, pressured by a dovish tone from the Bank of Japan (BoJ) despite an upward revision in inflation forecasts. While hopes remain for rate hikes later this year, Governor Ueda signaled patience, especially amid trade uncertainties following the U.S.-Japan deal. Political instability and fiscal concerns in Japan further weigh on the Yen. Meanwhile, the USD consolidates recent gains, supported by a hawkish Fed and strong economic data. Global risk sentiment soured after President Trump imposed up to 41% tariffs on key partners, offering slight support to safe-haven assets like the JPY. However, traders remain cautious ahead of the U.S. Nonfarm Payrolls data due later today.

At the time of writing, the USDJPY was trading at 150.65/150.66.

Recent Blog

Want to manage Forex?

Newsletter signup

Receive forex updates right in your mail box or Whatsapp