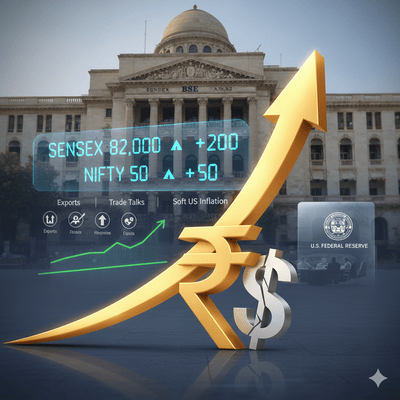

Morning Session – Indian Financial Market (16 September 2025)

Indian Rupee

The Indian rupee opened at 88.07 against the U.S. dollar on Tuesday, compared to its previous close of 88.21 on Monday. The Indian rupee strengthened, against the US dollar, its best performance in a week. This appreciation is primarily due to a weakening dollar, driven by growing market expectations that the US Federal Reserve will cut interest rates at its upcoming meeting. The rupee is also being supported by positive domestic factors, including soft US inflation data, ongoing US-India trade talks, and India's strong export performance, which has narrowed the trade deficit. Despite this recent gain, the rupee remains the worst-performing Asian currency this year, having depreciated by 2.87%. Analysts believe the rupee may remain stable or see further gains depending on the Fed's decision and continued financial inflows.

Indian Equities

Indian stock market showed a positive trend, with the Sensex nearing the 82,000 mark after rising by about 150-200 points, and the Nifty 50 index trading above 25,100 with a 50-point gain. The Nifty Bank also saw slight gains, while the Nifty Midcap 100 and Nifty Smallcap 100 indices both experienced an increase of around 155 points, keeping pace with the frontline indices. Major gainers included Mahindra & Mahindra, Kotak Bank, NTPC, and Powergrid, and in the broader Nifty 500, stocks like Godfrey Philips, Redington, KPR Mill, and NTPC Green saw significant increases. Additionally, textile stocks and Nifty India Defence stocks saw gains, the latter recovering from an initial slump.

Major gainers on Nifty were Kotak Bank, NTPC, Mahindra & Mahindra, Axis Bank and losers were Titan, Asian Paints, Nestle India, HDFC Life, Tata Consumer.

Indian Government Bonds

Indian government bond yields are predicted to stay within a narrow range on Tuesday, specifically between 6.48% and 6.52% for the 10-year benchmark note. This stability is expected as the market prepares for a smaller-than-scheduled sale of state bonds, which is unlikely to cause significant disruption. The primary focus for investors is the upcoming U.S. Federal Reserve meeting on Wednesday, where a 25-basis-point interest rate cut is widely anticipated. Market participants will be closely watching for clues on future rate cuts throughout 2025. Additionally, the recent news that JPMorgan will slightly reduce India's weightage in its emerging market bond index is not expected to have a major impact on the bond market, especially since foreign investment in Indian bonds has been strong due to a favorable interest rate differential.

The 10-year benchmark bond yield was trading at 6.479%.

Recent Blog

Ready to make smarter forex decisions?

Get timely market updates straight to your inbox and WhatsApp.