Manufacturing Client Optimises Treasury Operations, Saving 39.25 Lakhs in 6 Months

Client Profile

A kitchenware company based in Haryana, with an annual export turnover of 175 crores and import turnover of 50 crores. The company had been converting its receivables (exports) and payables (imports) on due dates but was funding its operations inefficiently.

The Challenge

The client faced several financial challenges, including:

1. Overcharging by the bank: The bank was levying an excess charge of 7 paisa per foreign currency transaction, and, ironically, it was debiting the cash spot rate on exports but not providing the cash spot credit on imports.

2. Currency risk: Payments for imports and exports were being made on maturity dates, leaving the company vulnerable to exchange rate fluctuations.

3. Operational inefficiencies: The company wasn’t settling imports with export proceeds, nor was it optimising forex market timings to lock in favourable rates. Additionally, they were not assessing the best financing options for exports and imports, leading to unnecessary transaction costs and higher interest expenses.

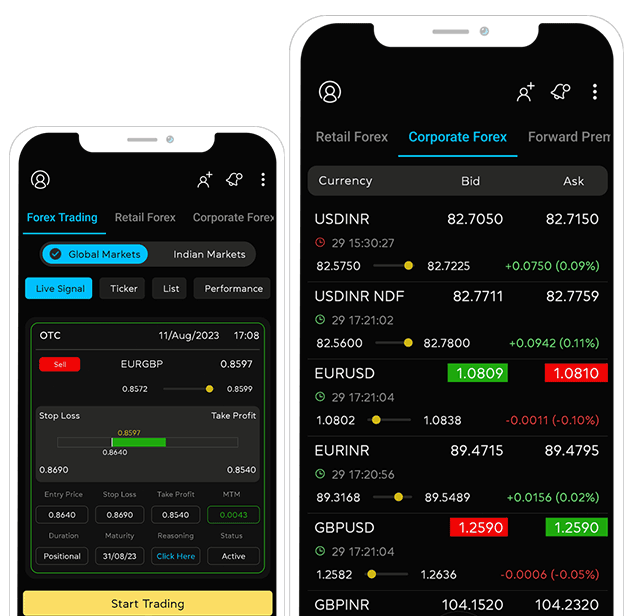

The Myforexeye Solution

Myforexeye implemented a comprehensive strategy to optimise the client’s treasury and forex operations:

1. Reducing bank charges

We negotiated with the bank to reduce the margin on foreign currency transactions from 7 paisa to the agreed 2 paisa. The client is now also entitled to receive cash for spot-on import payments.

2. Utilising the EEFC account

Since the client handles both imports and exports, we advised them to deposit their inward receivables into the EEFC (Exchange Earners Foreign Currency) account. This move helped mitigate currency risk and eliminate conversion charges by making payments for imports from the EEFC.

3. Market benchmark-based hedging policy

We introduced the First Day Forward Rate (FDFR) as a benchmark for hedging. This strategy allowed the client to lock in favourable rates and reduce exposure to currency volatility.

4. Optimising working capital management

By analysing interest rates and the USDINR spot rate, we guided the client on when to avail of Export Packing Credit (EPC) or Packing Credit in Foreign Currency (PCFC), helping them make informed decisions about working capital and saving further costs. We also suggested using non-fund-based limits like Letters of Credit (LC) or Standby Letters of Credit (SBLC) for financing imports.

Results and Impact

-Savings from overcharging by the bank: Reducing the FX transaction cost from 7 paisa to 2 paisa per foreign currency saved the client.

-Savings from EEFC account usage: By using the EEFC account to pay for imports, the client saved Rs. 2.05 lakhs in 6 months.

-Savings from FDFR hedging: The new hedging strategy, using FDFR as a benchmark, generated savings of Rs. 25 lakhs.

-Savings from optimised working capital management: Actively managing working capital based on interest rates and USDINR spot rates led to additional savings of Rs. 8.5 lakhs.

Conclusion

Through strategic optimisations in treasury and foreign exchange operations, Myforexeye helped the client save Rs. 39.25 lakhs over just 6 months. By reducing unnecessary conversion charges, mitigating currency risk using the EEFC account, improving the hedging strategy, and optimising working capital management, the client significantly enhanced financial efficiency and resilience against currency volatility.

Pending Optimization

The client currently has a Rs. 60 crore term loan. We plan to convert Rs. 25 crore of this term loan into a foreign currency loan to reduce the borrowing cost by 2% per annum.

Recent Blog

Ready to make smarter forex decisions?

Get timely market updates straight to your inbox and WhatsApp.