Indian Rupee Trading At 91.8825 Against The Dollar

Financial Market Overview

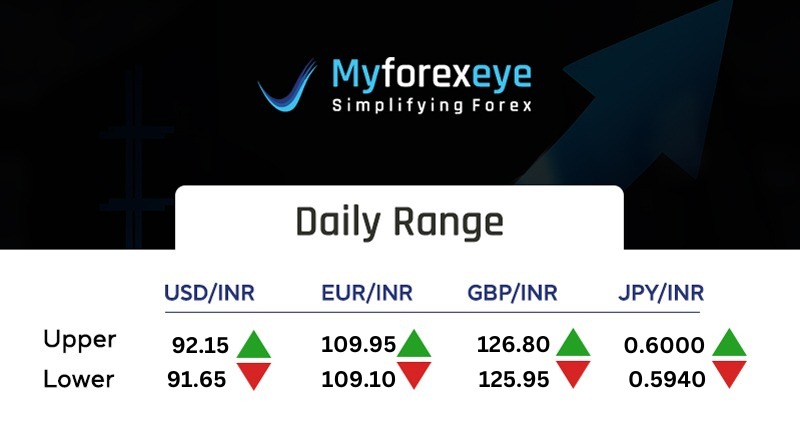

USDINR

The Indian rupee opened at 91.91 against the U.S. dollar on Friday, compared to its previous close of 91.9550 on Thursday. The Indian rupee is likely to open weaker on Friday amid poor Asian risk sentiment and sustained dollar demand, though traders say the Reserve Bank of India continues to act as a backstop near the 92-per-dollar level. After touching a record low of 91.9850 on Thursday due to NDF-related dollar buying and a persistent demand-supply imbalance, the currency is expected to open around 91.90 - 91.96, with intervention preventing a sharper fall but not guaranteeing a firm defense of 92. The rupee is down about 2.3% this month, its worst performance since September 2022, pressured by bullion-related dollar demand, ongoing equity outflows, muted exporter hedging and rising depreciation expectations, while additional headwinds come from weaker Asian markets, rising oil prices driven by Middle East tensions, and global uncertainty following reports that Kevin Warsh may be nominated as the next U.S. Federal Reserve chair.

United States 10-Year rates were 4.267% on the bond markets, while 2-year Treasury yields were 3.569%. The DXY index trading around 96.593.

At the time of writing, the USDINR was trading at 91.8825/91.8925.

EURUSD

EURUSD edges higher toward 1.1965 in early Asian trading on Friday as the US Dollar remains under pressure from ongoing uncertainty around US trade policy and renewed concerns over the Federal Reserve’s independence. The greenback weakened after President Trump downplayed dollar softness and said he would name a new Fed chair next week, reinforcing expectations of rate cuts and raising doubts about central bank autonomy, despite reassurances from Treasury Secretary Scott Bessent about a strong-dollar policy. While these factors provide near-term support to the euro, upcoming Eurozone and German GDP data and Germany’s flash CPI could cap gains if they disappoint, with US PPI data and remarks from Fed official Alberto Musalem also in focus later in the session.

At the time of writing, the EURUSD was trading at 1.1917/1.1918.

GBPUSD

GBPUSD slid below 1.3780 in North American trading as the US Dollar surged after the Federal Reserve kept interest rates unchanged and struck a more neutral tone, downplaying risks to the labor market. Powell’s comments reinforced confidence in the resilience of the US economy, pushing the DXY sharply higher and triggering broad selloffs across risk assets, including equities, gold, silver and cryptocurrencies, which weighed heavily on Sterling. Although US jobless claims rose slightly above expectations, the Fed emphasized stability following last year’s rate cuts, further supporting the Dollar. With no major UK data releases, market attention now shifts to the upcoming Bank of England policy decision and growing UK political uncertainties, both of which could pose additional headwinds for the pound.

At the time of writing, the GBPUSD was trading at 1.3750/1.3751.

USDJPY

The Japanese Yen weakened during the Asian session after Tokyo CPI data showed inflation cooling to a near four-year low, reducing expectations for an imminent Bank of Japan rate hike. The softer inflation figures, combined with concerns over Japan’s fiscal health tied to Prime Minister Sanae Takaichi’s stimulus-focused policies and political uncertainty ahead of the February 8 snap election, weighed further on the currency, helping push USDJPY toward the 154.00 area. Still, fears of possible coordinated US-Japan intervention, along with heightened geopolitical tensions and global trade uncertainties, helped limit deeper JPY losses, while the US Dollar’s upside remained capped by expectations of further Fed rate cuts and concerns over the central bank’s independence.

At the time of writing, the USDJPY was trading at 153.95/153.956.

Recent Blog

Ready to make smarter forex decisions?

Get timely market updates straight to your inbox and WhatsApp.