Indian Rupee Ended the Day at 87.5425 against the US Dollar

Financial Market Overview

Indian Rupee

The Indian rupee closed at 87.5425 on Friday in comparison to its previous closing at 87.5975 on Thursday evening. The Indian rupee saw a modest gain, closing at 87.53 against the US dollar, up 12 paise. This appreciation was primarily attributed to declining crude oil prices and likely intervention from the Reserve Bank of India (RBI), which analysts believe stepped in to curb further depreciation after the rupee hit record lows earlier in the week. Despite this recovery, market sentiment remained cautious due to the US imposing a 25% tariff on Indian exports, effective August 7, and an additional penalty on India's purchases from Russia, leading to a "risk-off sentiment" among investors. These trade concerns also impacted India's stock market, with the Sensex dropping by 586 points and foreign institutional investors continuing to pull out funds.

Indian Equities

The Nifty 50 index was down by 203.00 points at 24,565.35, while the Sensex was down by 585.67 points to 80,599.91.

1264 shares increased in value, 2582 shares decreased, and 154 shares were steady.

Among Nifty's top gainers were Sun Pharma, Dr Reddy's Labs, Adani Enterprises, Tata Steel, Cipla while losers were Trent, Asian Paints, Hero MotoCorp, HUL, Nestle.

Global Market

Asian market finished negative as follows: Hong Kong’s Hang Seng was down 337.33 points at 24,436.00, Nikkei 225 was down 224.82 points at 40,845.00 and China’s Shanghai composite is down 13.26 points at 3,559.95.

European markets traded negative: French CAC 40 decreased by 176.47 points at 7,595.50. The DAX decreased by 448.77 points at 23,616.70 and FTSE was down by 56.16 points to 9,076.65.

Over on Wall Street, the S&P 500 index futures decreased by 73.75 points, reaching 6,300.50. Simultaneously, the Nasdaq 100 index futures decreased by 308.75 points, totaling 23,056.25 while the Dow Jones Industrial Average futures decreased by 488.00 points, reaching 43,817.00.

The price of a barrel of Brent crude decreased by 0.78 points to $71.03.

Recent Blog

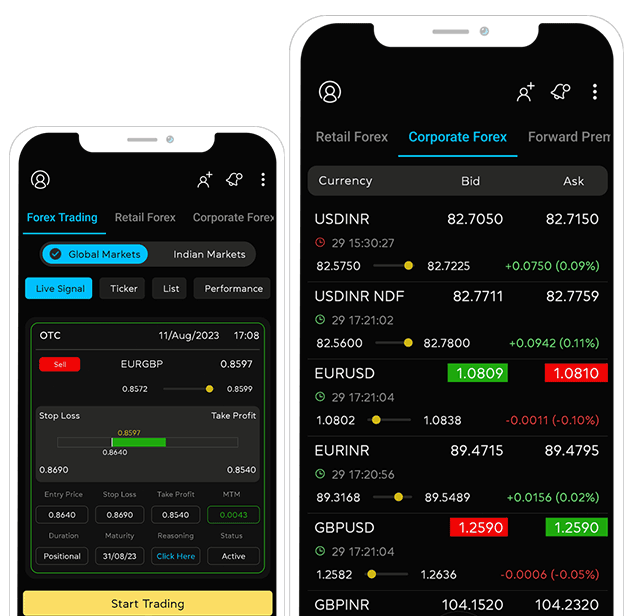

Want to manage Forex?

Newsletter signup

Receive forex updates right in your mail box or Whatsapp